japan corporate tax rate 2018

Corporate Income Tax Rates 2018-2022 lists current and historic statutory national corporate income tax rates for the years 2018 to 2022. 99 movement in RD ratio - 8 03 α upper limit is 10 α RD expenditure ratio - 10 x 05.

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

So gross effective tax rate of company is 2239.

. 5 Standard rate 123 percent of the central tax. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence. Calculation of corporation tax in Japan.

The preferential tax credit limitation see below provides. Current Japan Corporate Tax Rate is 4740. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced.

Regular business tax rates vary between 16 percent and 372 percent depending on the tax base taxable income and the location of the taxpayer. National Income Tax Rates. Corporate Inhabitant taxes 1.

In the case the amount of pretax profit zeibikimae Junrieki 税引前純利益 is 1 million yen. Income from 9000001 to 18000000. Donation made to designated public purpose companies.

The maximum rate of 147 percent is levied in Tokyo metropolitan. Tax rates for companies with stated capital of more than JPY 100 million are as follows. Overview of the Consumption Tax System in Japan - May 2018 Yasutaka Nishikori Nishimura Asahi 1 Historical Background.

For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less. 21569 02969 140 USDCAD. Corporate Tax Rate in Japan averaged 4083 percent from.

Please note that the personal exemptions shown. An under-payment penalty is imposed at 10 to 15 of additional tax due. Local corporation tax applies at 44 on the corporation tax payable.

Corporate Inhabitant taxes 2. In the case that a. 14 14 Taxable Year of Companies.

Paid-in capital of over 100 million. Last reviewed - 02 March 2022. The consumption tax rate to 10 which includes a 22 local.

15 15 Taxable Income. 069390 000004 001 Silver. Corporate - Group taxation.

025 of capital plus capital surplus 25 of income x 14. Japan Corporate Tax Rate chart historic and current data. Assumed that taxable amount of your.

5 rows Corporation tax rate 1 April 2016. 79215 01295 166 home. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018.

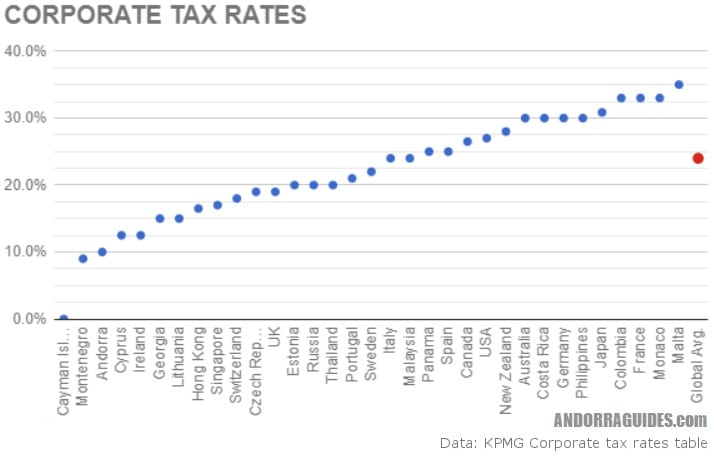

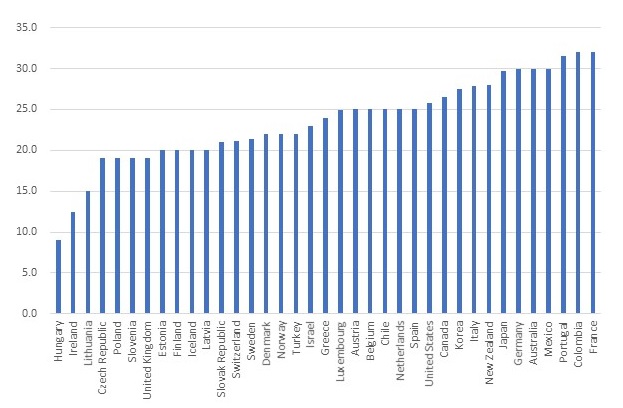

Effective Statutory Corporate Income Tax Rate. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. 129895 -000380 -029 Corn.

The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen. The rate is increased to 10 to 15 once the tax audit notice is received.

You can download excel file here. Corporate resident tax Hojin Juminzei. Tax rates The tax rate is 232.

Calculation of corporate tax of Japan Sheet. Special local corporate tax rate is 935. 6 The special local tax is 81 percent of the prefectural enterprise tax for.

Final tax return Corporations are. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Income from 400000001 and above.

Income from 18000001 to 400000000. Download the PDF Withholding Tax Rates 2022. Corporation tax is payable at 234.

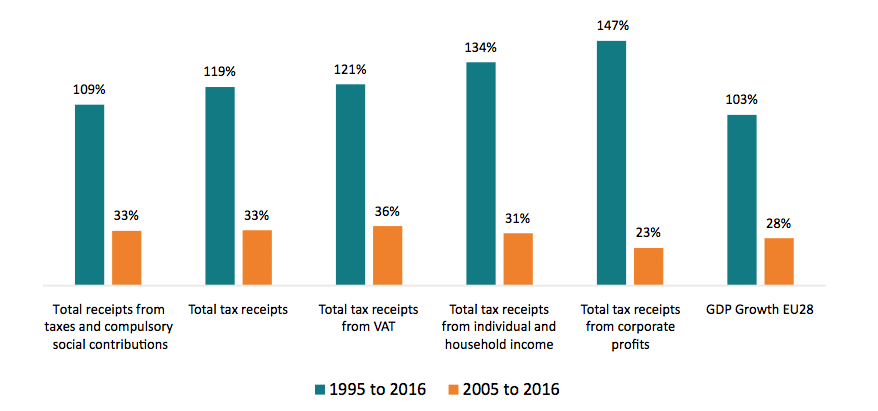

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Real Estate Related Taxes And Fees In Japan

The Andorra Tax System Andorra Guides

Tax Burden Soared Under Moon Administration

Digital Companies And Their Fair Share Of Taxes Myths And Misconceptions

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Corporate Tax Reform In The Wake Of The Pandemic Itep

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

U S Income Tax Revenues And Forecast 2031 Statista

Capital Gains Tax Japan Property Central

Real Estate Related Taxes And Fees In Japan

Be Cautious About Raising The Corporation Tax Rate Oxford University Centre For Business Taxation

Corporate Tax Reform In The Wake Of The Pandemic Itep

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax